Aneka Tambang (ANTM) Assesses Bauxite Downstreaming Needs to Be Accelerated

industri.kontan.co.id

3739 Views

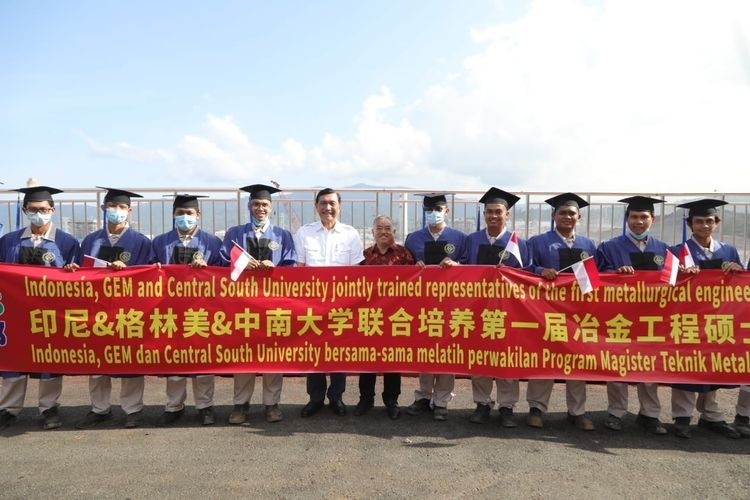

PT Aneka Tambang Tbk (ANTM) or Antam is committed to continuing to support the downstreaming of mineral mining commodities, including bauxite. What's more, the government already plans to ban the export of raw bauxite in 2023. General Manager of Antam UBP Bauxite West Kalimantan Anas Safriatna said, Indonesia actually has abundant bauxite reserves. Specifically for Antam, this company has bauxite reserves of 105.95 million wet metric tons (wmt) as of the end of 2020. Meanwhile, Antam's bauxite resource is at the level of 585.83 wmt. It's just that, it must be admitted that the bauxite market in Indonesia is currently still limited. Antam itself can only supply bauxite ore to three domestic smelters, namely PT Indonesia Chemical Alumina (ICA), which in fact is a subsidiary of Antam, then there is PT Well Harvest Mining, and PT Bintan Indonesia Alumina. Most of Antam's bauxite is exported abroad. PT ICA has so far only been able to process bauxite into alumina, while for aluminum it must be processed again in a smelter owned by PT Inalum whose production capacity is 250,000 tons per year. "The need for aluminum in Indonesia reaches 1 million tons, but our production capability in the MIND ID Group is only 250,000 tons. There is still a gap that must be met," said Anas when met by Kontan, Thursday (22/9). He also assessed that the addition of bauxite processing smelters in Indonesia is very important to do, but while still paying attention to the readiness of the existing market. In addition to reducing imports of bauxite derivative products, the development of smelters is also useful because it will increase the added value of the bauxite commodity itself. Anas gave an example, the price of bauxite ore is currently in the range of US $ 30--US $ 35 per ton. When processed into alumina, the price can rise to US $ 500 per ton. The price increase will occur again when alumina is successfully processed into aluminum. "To maximize existing reserves, we really need to continue to develop downstream," he said. Apart from through PT ICA, Antam and MIND ID are currently building a Mempawah Smelter Grade Alumina Refinery (SGAR) which is included in the National Strategic Project (PSN). This project costs a budget of US$ 831.5 million.Source: https://industri.kontan.co.id/news/aneka-tambang-antm-menilai-hilirisasi-bauksit-perlu-dipercepat