MEMR Notes 320 Coal Mine RKABs Remain Pending Approval

Dimas Ardian/Bloomberg

3860 Views

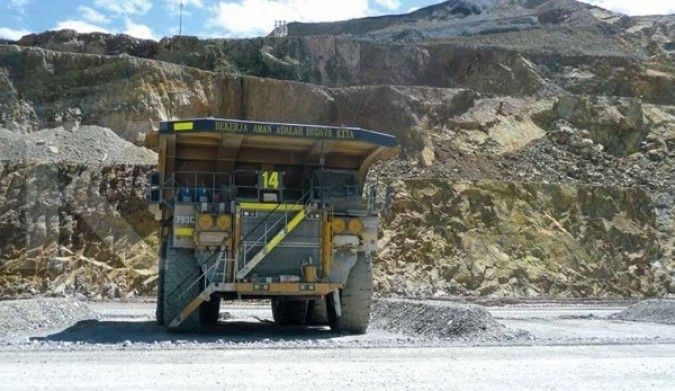

The Ministry of Energy and Mineral Resources (MEMR) revealed that it has just approved 480 work plans and cost budgets (RKAB) of coal mining companies out of around 800 RKAB in total submitted to the government. This means that, until now, there are still as many as 320 RKABs of mining companies that have not been approved or are still in process.Director of Coal Business Development of the Directorate General of Mineral and Coal of the Ministry of Energy and Mineral Resources, Lana Saria, said the stalled granting of RKAB permits to 320 companies was because there were still many problems."There are those with unpaid debts, so they are rejected, or their PPM [Community Development and Empowerment] has not been settled. The MODI's affairs are also not registered yet by the directors, so we are returning them," said Lana in Jakarta on Monday (1/29/2024).This requirement is a provision that must be obeyed by companies that want to apply for RKAB in line with the new rules regarding mining governance.The regulation is contained in MEMR Ministerial Regulation No. 10/2023 concerning Procedures for Preparation, Submission, and Approval of Work Plans and Cost Budgets and Procedures for Reporting on the Implementation of Mineral and Coal Mining Business Activities. This regulation makes it easier for companies to apply for RKAB. One of them, from the original, had to apply once every 1 year to once every 3 years.Coal illustration (Image source: Bloomberg)Substantially, the other main facilities regulated in the regulation signed in September 2023 are the fulfillment of essential aspects in the preparation of RKAB and the efficiency of the timeline.Then, the ministry has also created the E-RKAB platform as an effort to digitize monitoring, evaluating, and facilitating the submission of RKAB with ease.The platform is under the instructions in the MEMR Ministerial Decree Number 373 3.K / MB.01 / MEM. B/2023 concerning Guidelines for the Implementation of Preparation, Evaluation, Work Plan Approval, and Cost Budget in Mineral and Coal Mining Business Activities.In that regard, Lana said, the RKAB approval process depends on the company's sincerity in completing the returned documents by existing provisions."Everything must be organized and settled first, before applying to us again. It's up to them to sort everything out so they can do their activities again."Citing data from Minerba One Data Indonesia (MODI) of the Directorate General of Mineral and Coal of the Ministry of Energy and Mineral Resources until January 29, 2024, MEMR recorded to have granted as many as 916 coal mining business permits (IUP).In detail, the total licenses consist of 9 coal exploration licenses and 910 coal production operation permits.Image source: Dimas Ardian/BloombergSource: www.bloombergtechnoz.com/ESDM Sebut 320 RKAB Tambang Batu Bara Belum Disetujui