PT Mifa Bersaudara Commits to Aceh Mining Sustainability In 2024

SERAMBINEWS.COM

3207 Views

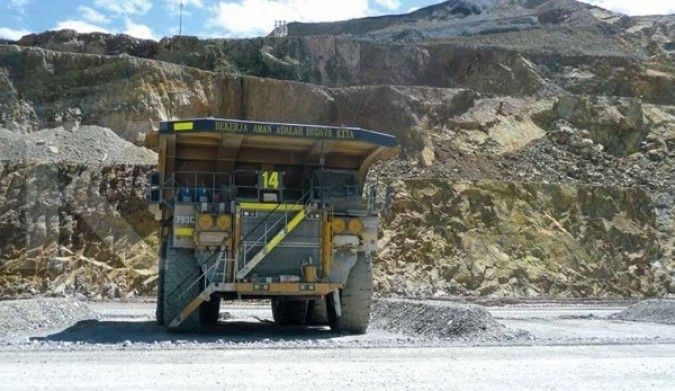

The management and all employees of PT Mifa Bersaudara and

all operational partners are committed to continuing to improve performance

and implementation of the K3 culture in 2024, so as to maintain the

sustainability of the mining business in Aceh.To carry out this commitment, Deputy Head of Mining

Engineer of PT Mifa Bersaudara, Abdul Haris, emphasized that it takes

discipline and consistency of all parties to continue to ensure that their work

area is protected from unsafe conditions and actions and maintains a healthy

lifestyle."Hopefully, this joint commitment will make PT Mifa Bersaudara is a safe and healthy place to work, so that employees are more

productive in working to achieve the targets set in 2024," he said during

the Opening Ceremony of the 2024 National K3 Month at PT Mifa Bersaudara. Commitment to Improve Performance and Implement K3 Culture in 2024 It is recorded that until the end of 2023, the number of

workers in the IUP area of PT Mifa Bersaudara is 2,920, with a total working

hours of 6,777,897 hours.In 2024, PT Mifa Bersaudara has set a threshold for the

tolerable statistical level of occupational safety for property damage

frequency rate of 3.60 and a total injury frequency rate of 0.30."While tolerable occupational health statistics for

disease severity based on absenteeism (Absence Severity Rate) of 200, morbidity

frequency rate of 120 and frequency of occupational disease (PAK) of 0

percent," concluded Haris.Hasbuna, representative of DISNAKER Aceh province, expressed

his gratitude for the participation of PT Mifa to start this good step of K3

by holding a memorial ceremony involving all stakeholders involved in the

company.He hopes for this K3 to be improved continuously. "Earlier we also heard information that there was a slight excess of the target achievement, so the improvement of work safety, especially in the mine, must be further improved," Hasbuna said.For him, what is targeted by the management in 2024 can be

achieved and this requires support from all parties, especially all employees.

so supervision is important in K3 but more importantly, the understanding

of all employees, personal safety and company safety are even more important.Image source: SERAMBINEWS.COMSource: www.aceh.tribunnews.com/Komitmen Tingkatkan Performa & Penerapan Budaya K3 di Tahun 2024